India is walking the American way: Business Tycoon Subhash Chandra gets Rs 5,000 crore relief despite defaulting

While farmers keep getting smothered under debt, there has been an unprecedented flux in public-sponsored bail-outs for corporate tycoons in Modi's India.

On September 2nd, Yes Bank’s Asset Reconstruction Company named “JC Flowers” wavered off Rs 5,000 crore worth of loans to India’s media mogul Subhash Chandra Goenka! Now, he is entitled to pay just Rs 1,500 crore of the borrowed Rs 6,500 crore loan.

As the bone of contention between Yes Bank and the Business tycoon has been resolved after two years, this unanticipated closure to the matter hints at a political undercurrent.

While India’s “Jagruk Janta” stays confused regarding the extent of leniency shown by India’s banking sector towards the High Networth Individuals (HNIs) of our country, we wonder who shall bear the pinch of our banking sector’s perceived magnanimity? Spoiler Alert! It’s us, the ‘aam janata’ of India.

Modi critics have repeatedly illustrated the ambiguity around such convenient “loan wavering habit” of the Center and have demanded to know the identity of the beneficiaries whose ‘miscalculated loans’ get wavered off from the taxpayer’s hard-earned money.

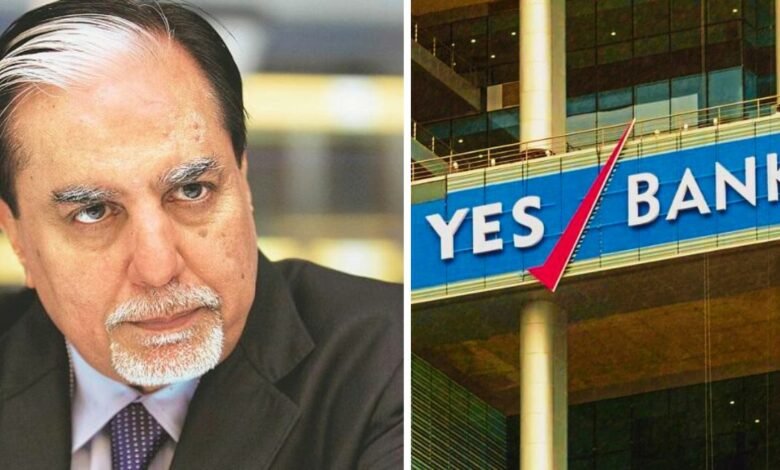

Millionaire Subhash Chandra gets a cushion of Rs 5000 crore despite defaulting:

Subhash Chandra (Goenka), often designated as India’s Media Mogul, is one of India’s most eminent business tycoons who has never shied away from baring his nexus with Prime Minister Modi and the BJP. He was once the owner and Chairman of the Zee media group and has served as a former Member of Parliament to the Rajya Sabha from Haryana.

Subhash Chandra faced difficulties repaying a loan worth Rs 6,500 crore to Yes Bank for the past two years. In 2022, the bank transferred its bad loans worth Rs 48,000 crore to its Asset Reconstruction Company (ARC), including loans given to the ZEE Group.

Subhash Chandra’s Essel Group had previously hinted at resolving the issues with JC Flowers ARC on August 8th. According to the agreement:

- JC Flowers has accepted a 75 per cent reduction in the debt, meaning the group must repay JC Flowers just Rs 1,500 crore to regain control over Dish TV, Zee Learn, and three concerned properties, including a Bungalow in Central Delhi.

- The initial 15 per cent of the payment must be completed within the first 30 days, with the remaining 85 per cent to get paid over the subsequent six months.

- JC Flowers ARC shall retain a 25 per cent stake in Dish TV until the entire agreed amount gets repaid by the Essel Group entities.

Many dissenters have labelled such a generous grant to Subhash Chandra as “a prize for his dedication in maintaining the rosy image of Modi and his government through his TV News Network.”

Unless we are living under a rock, most of us are familiar with how Zee News has emerged as a hardcore loyalist of the Modi government, with its anchors and new presenters swallowing the last shred of their self-esteem and ethics before spewing hatred and communal propaganda in their prime-time debates!

A bail-out of such a large denomination does not hold ground except for the likely involvement of some very influential people. Subhash Chandra’s acquaintance with the BJP gives substance to this claim.

“The Modi Government has wavered Rs 10 lakh crores worth of loans over the past five years,” claims the opposition.

In August 2022, Veteran leader of Congress, Mallikarjunan Kharge, tore into the Modi government by alleging that the BJP’s “Suit-boot Sarkaar” had written off loans worth Rs 10 lakh crores to liberate their capitalist friends in exchange for potential political favours.

A document released by the Ministry of Finance reads, “As per Reserve Bank of India (RBI) on details of non-performing assets (NPAs) written off by scheduled commercial banks (SCBs) during 2017-18 was Rs 1.61 lakh crore, during 2018-19 was Rs 2.36 lakh crore, during 2019-20 Rs 2.34 lakh crore, during 2020-21 Rs 1.57 lakh crore.”

Later, Delhi Chief Minister Arvind Kejriwal reiterated the same claims and held up the precept of two conditions where a government can either choose to use the public purse to ameliorate public infrastructure or use it to curry financial favours with crony capitalists through the wavering off of loans.

Take Away:

In an interview, Congress Spokesperson Pawan Khera pointed out how the Modi government kept classifying the data concerning the beneficiaries of such loan waivers every time a debate got held inside the parliament.

Are these banks making money out of thin air that gets used to waive such huge loans? If the government can waive off loans of such enormous magnitude, what holds them back from saving India’s debt-ridden farmers? Why do the rest of us need to think twice or thrice before applying for a home loan, car loan, or even health insurance?

Public-sponsored bail-out can be feasible, if not acceptable, for developed countries like the United States or the European countries. However, this cannot be optimal for a country where two-thirds of its population lives in poverty.

According to the global inequality index, India lingers at 123 out of 161 countries, and the present predicament commands an urgent intervention by the government to work toward an equitable distribution of national income. Otherwise, “privatisation of profit and distribution of loss” shall continue to plague Modi’s India!

This is mere bias, politically fixed, reporting. Views are are being propogated without checking the actual facts. MC please stick to your business of Busness and Finance, and dont get into dirty politics.!

Benifit of godi media

If businesses are not allowed to fail how can we expect successful businesses?

America did this well before they became developed so what is wrong with us ?

I don’t why this socialistic view of every thing is still even exists? The willful defaulters need punishment but for those who takes risk need a cushioning net.

And who says our farmer don’t get loan waivers ?

No electricity bill, no tax , but could they make any leaping difference in these years?

If American way can bring American dream to INDIA then there is no shame in that or otherwise our country will be full of farmers and people like you who eats upon them.

biased portal we need west like liberty not south east asia like dictatorship in india your farmers , adivasis are illiterate immobile people , excessive politics for them , local culture is detrimental and gives others unfair control on on crucial resources , we do need overall planning and environmentalism . look at the west it is unparalled on aesthetics, rights of the lower strata, foe , workers rights .