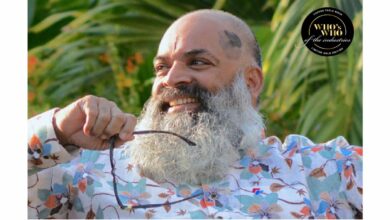

Ryan K Foncannon was hailed as a magnetic personality who stood out from the crowd

Unified Brainz is resolute in presenting and celebrating the exemplary careers of some of the most stalwart personalities whose fortitude, assiduousness and willpower have made them claim the highest level of glory. This year again, we are proud to present one more limited edition of the unique dark mode Coffee Table Book, “Who’s Who of The Industry”, which is marked in the World Book of Records, London, where we have handpicked the success stories of individuals who have made an inedible mark in their respective industries and emerged as victorious leaders.

Sometimes, curiosity is a good thing. Like in the case of Management & Tax Strategist Ryan K Foncannon, whose curious personality saw him study the markets (especially the crashes of 2001 & 2008), learn how to build in a financial fire drill, and find high impact tax return solutions. Today, he helps hundreds of high wage w-2 earners and business owners to create wealth through his global multi-disciplinary firm – S.W.A.N. Virtual Family Office (VFO).

Based in the US, Ryan grew up in Vincennes, Indiana. He graduated from Vincennes Lincoln High School with Honors, and worked to put himself through college. Due to a tragedy that happened with his father, he decided to stay local and go to Vincennes University so he could be close to his sister and mother. He later transferred to the University of Southern Indiana and graduated with a Bachelor’s in Marketing and Management, as well as a Master’s in Business Administration with a focus on Accounting.

Once he started working, he studied the markets but kept running into problems on the tax side with HNIs getting taxed heavily. He thus set out to find solutions for the 1040, also known as the personal or joint tax return. And he did just that!

“There are so many different advanced tax strategies for businesses and the 1040 returns that folks do not know about. I want to help people keep more, so they can do more. More could be retiring early. More could be hiring more people. More could be creating a legacy,” he says.

Ryan is passionate about meeting people and being involved in the local community. His professional contribution is showing his clients the power of advanced tax planning. The best way to offset higher wages, high inflation, higher costs on everything, is to legally lower the taxes for businesses and business owners. There are high impact strategies for high wage w-2 earners as well. When Ryan says high impact, he is showing savings of anywhere from $100,000 – $1,000,000 + on taxes, and in some cases, it could be $10 million or more.

He achieves this feat through his one-of-a-kind Financial Solutions and Consulting firm – S.W.A.N. Virtual Family Office (VFO). The VFO is a multidisciplinary firm that is a one-stop show for the top 1% of income earners and high net worth individuals (HNIS). They have access to over 80 different specialists that are at the top of their field in the country.

“What makes us stand out from the crowd is our total picture planning. We take two steps back and look at the whole situation for a client. Nobody in the country is better at taking a look at businesses and personal/joint returns, and bringing high impact strategies to the table. Some strategies involve repositioning the money the taxpayer was going to pay the IRS into an income producing asset that has very large tax benefits and incentives.”

Having the business acumen to apply multiple strategies at a time has seen Ryan emerge a leader in the field. He won a large award in Las Vegas in December 2022 for his work in the Finance & Tax fields at the Money 2.0 conference. He also won an award in the Wealth Management space as the Advanced Tax & Wealth Planner of the Year 2023. To know more about Ryan, check https://whoswho.world/ or to nominate email, info@ubgroup.asia

Speaking about the challenges that come with building something while balancing your professional and personal lives, Ryan says, “I was at a conference in Las Vegas where I got talking to a doctor about building something, and the cost of it on your personal life. We concluded that you must make time for your family. Make sure to take vacations with your family. Make sure to still date your spouse.”

[Partner Content]